The Global Blockchain and Crypto Market Overview 2025

- Wuxia (Amy) Bao

- Nov 8, 2025

- 23 min read

In 2025, the blockchain and crypto industry has entered a new stage of scale, regulation, and brand maturity. Global crypto market capitalization surpassed about USD 3.9 trillion (2024: USD 2.7 trillion, +44 %) . Worldwide crypto ownership reached over 580 million people, up ~18 % from 2024 . The Asia-Pacific region accounts for roughly 37.6 % of total holders (2024: 30 %), leading global growth .On-chain activity grew even faster: 2025 Global Adoption Index shows regional transaction value rising ~69 % year-on-year (2024: +45 %), driven by emerging economies, institutional inflows, and mainstream Web3 applications. Regulation matured in parallel. Major jurisdictions now define stablecoins, exchange, custody, and marketing disclosure frameworks. For marketers, this means brand storytelling must weave compliance, culture, and technology fluency into one narrative.

How to Evaluate a Country’s Marketing Potential

Crypto-friendly nations can be evaluated through six interlinked dimensions that determine how easily a brand can enter, communicate, and grow.

Regulatory clarity, which covers the presence of defined licensing for virtual asset service providers, explicit stablecoin frameworks, and clear standards for marketing conduct. For example, Singapore’s Monetary Authority (MAS) established precise rules under the Payment Services Act and its 2024–2025 amendments, granting more than twenty-nine Digital Payment Token licenses and publishing detailed marketing conduct guidance—making it one of the clearest environments for brand communication.

Tax environment, where predictable and transparent treatment of capital gains, trading income, and corporate activity builds investor confidence. Germany illustrates this dimension: the Ministry of Finance’s 2025 clarification confirms that privately held crypto sold after one year remains tax-exempt for individuals, allowing marketers to frame crypto as a long-term, tax-efficient investment.

Financial infrastructure, including the accessibility of crypto-friendly banks, fiat on- and off-ramps, payment networks, and custodial systems that enable liquidity and trust. For instance, in Switzerland, banks such as SEBA and Sygnum operate under FINMA oversight, offering regulated custody and settlement channels that connect traditional finance and blockchain seamlessly.

Adoption and ecosystem maturity, reflected in user penetration, startup density, developer activity, and transaction throughput. India has more than ninety million crypto users and a thriving developer scene that powers global DeFi, payments, and gaming applications.

Economic and political stability, encompassing currency reliability, rule of law, and connectivity that allow consistent business operations. Fo example, the United Arab Emirates demonstrates this stability, combining pro-innovation leadership with macroeconomic strength, clear virtual asset regulation through VARA, and a predictable business environment that gives international firms confidence to invest and advertise.

Finally, innovation and institutional support play a decisive role, as governments that launch sandboxes, tokenization frameworks, and blockchain education initiatives create credibility and talent pipelines for sustainable growth. For instance, in the United States, the SEC’s approval of spot Bitcoin and Ether ETFs opened institutional gateways; the Federal Reserve and major banks advanced pilots for tokenized deposits and blockchain-based settlement under the Regulated Liability Network initiative. These efforts showcase deep institutional engagement and a maturing regulatory dialogue that marketers can leverage to frame the U.S. as a center of compliant, large-scale innovation.

Countries that perform strongly across these six dimensions provide the most fertile ground for blockchain and crypto marketing strategies—environments where compliance, technology, and culture can align to accelerate adoption and where storytelling can confidently bridge regulation, trust, and user experience. Now, let's have an overview on the highlight countries.

United States

In 2025, the United States solidified its status as the world’s largest regulated crypto economy. The SEC’s approval of spot Bitcoin and Ethereum ETFs transformed institutional access, driving crypto market capitalization in the U.S. to over USD 1.4 trillion and boosting institutional inflows by 37 % year-on-year. The IRS introduced Form 1099-DA for crypto brokers, establishing standardized tax reporting effective from January 2025, which marked a decisive step toward mainstream financial integration. Combined with active pilot programs under the Federal Reserve’s Regulated Liability Network (RLN) and Treasury’s ongoing stablecoin framework debate, the U.S. regulatory stance is now defined by control through compliance rather than restriction.

User adoption remains robust: about 55 million Americans (≈21 % of adults) hold crypto assets, with usage shifting from speculative trading to ETF exposure, payments, and tokenized-asset investing. Demographically, Gen Z and millennial investors dominate, and household-income surveys show crypto penetration rising fastest among those earning USD 100–150 k. The consumer story is no longer about novelty but portfolio diversification, loyalty integration, and real-world utility.

The domestic blockchain ecosystem spans regulated exchanges (Coinbase, Kraken), fintech leaders (PayPal’s on-chain stablecoin PYUSD), and infrastructure giants (Consensys, Circle). Tokenization of real-world assets (RWAs) grew 40 % in 2025, led by projects in treasury-backed tokens and digital-bond pilots by major banks. The U.S. narrative centers on trust, compliance, and scale, a mature environment where brand value comes from regulatory credibility and institutional collaboration rather than speculative hype.

The projected revenue in the Cryptocurrencies market in United States vs Worldwide (May 2025)

The number of users in the Cryptocurrencies market in United States vs Worldwide (May 2025)

India

India ranked #1 globally on the 2025 Crypto Adoption Index, reflecting both retail scale and developer depth. The government maintains a strict but pragmatic framework: crypto income is taxed at a flat 30 % with 1 % TDS (Tax Deducted at Source) on transactions, while all exchanges must register with the Financial Intelligence Unit (FIU) for AML compliance. Though crypto is not legal tender, regulation through taxation and reporting has effectively legitimized operations, anchoring one of the world’s fastest-growing compliant ecosystems.

India’s crypto user base exceeds 90 million, growing 20 % YoY, with activity now reaching Tier-2 and Tier-3 cities. Younger investors (ages 18-35) dominate, and UPI familiarity drives seamless adoption of wallets and on-ramps. The digital rupee (CBDC) pilot by the Reserve Bank of India expanded in 2025, integrating with commercial banks and demonstrating how tokenized settlement can complement private-sector crypto use cases.

Major players, CoinDCX, WazirX, ZebPay, and CoinSwitch, anchor the domestic trading ecosystem, while a growing developer community supports DeFi, GameFi, and infrastructure projects serving global clients. Blockchain-based remittances and cross-border payments are rising rapidly, representing 15 % of all crypto transfers in 2025. India’s message is mass adoption at scale, a mobile-first, youth-driven, regulation-aware market where education, localization, and accessibility outperform hype.

The projected revenue in the Cryptocurrencies market in India (May 2025)

The number of users in the Cryptocurrencies market in India (May 2025)

Singapore

Singapore remains the benchmark for balancing regulatory precision with innovation agility, reinforcing its leadership as Asia’s most strategically positioned digital-asset hub. The Monetary Authority of Singapore (MAS) fully implemented the Stablecoin Issuance Framework, the first in Asia to set capital, redemption, and reserve-asset standards for fiat-backed stablecoins such as USD and SGD. Parallel to this, the Payment Services (Amendment) Act 2024 came into effect, expanding MAS oversight to include overseas-only service providers, thereby ensuring that firms serving non-resident customers remain accountable under Singaporean compliance standards. As of mid-2025, 29 Digital Payment Token (DPT) licenses have been granted, up 13 from the previous year, with new entrants including Coinbase Singapore, Ripple Markets, and Paxos Asia. This policy architecture gives Singapore a unique dual appeal: the legal rigor demanded by institutions and the operational flexibility required by innovators.

Taxation and governance frameworks further enhance Singapore’s attractiveness. The city-state continues to impose no capital-gains tax on cryptocurrency transactions, and corporate profits are taxed at a moderate 17 percent, with incentives for financial innovation and fintech R&D. The Inland Revenue Authority of Singapore (IRAS) released updated 2025 guidance clarifying the tax treatment of staking and airdrop rewards as income only when received through organized business activities. Meanwhile, the MAS strengthened consumer-protection standards under the Payment Services Regulations (Amendment 2025), requiring licensed entities to segregate customer assets and maintain cybersecurity resilience. Together, these measures position Singapore as Asia’s first jurisdiction to achieve regulatory convergence between stablecoin, custody, and anti-money-laundering supervision, an achievement that regional peers are still working toward. The resulting environment is one of predictable oversight with open innovation, allowing institutions and startups to coexist in a shared, high-trust financial system.

The ecosystem reflects this maturity and diversity. Institutional adoption through banks, fintechs, and corporates surged 22 percent year-on-year, led by collaborations between DBS Bank, OCBC, and Standard Chartered in tokenized bond and payment pilots. Crypto ownership among consumers reached 11.4 percent of the population, driven by affluent, mobile-first professionals and cross-border entrepreneurs. Major exchanges such as Crypto.com, Binance Asia, and Independent Reserve continue to scale regulated operations, while local infrastructure firms like Matrixport, Fireblocks APAC, and Amber Group support custody and liquidity services. Singapore’s blockchain activity now extends beyond finance into supply-chain tokenization, green finance verification, and digital identity, supported by national programs such as Project Guardian, MAS’s multi-bank initiative for tokenized asset interoperability. Marketing in Singapore succeeds when it emphasizes safety, compliance, and institutional partnership, using bilingual storytelling in English and Mandarin to appeal to a cosmopolitan audience. Campaigns that align with regulatory messaging and highlight utility over speculation, such as faster remittances, corporate payments, and tokenized foreign exchange, resonate most strongly in a market where trust, transparency, and efficiency define success.

The projected revenue in the Cryptocurrencies market in Singapore (May 2025)

The number of users in the Cryptocurrencies market in Singapore (May 2025)

Japan

Japan has reasserted itself as one of the world’s most structured and compliance-oriented crypto markets, advancing reforms that bridge regulatory conservatism with renewed digital-finance ambition. The Financial Services Agency (FSA) continues to oversee crypto exchanges under the Payment Services Act and the Financial Instruments and Exchange Act (FIEA), which together define crypto assets as legally recognized financial instruments. A significant 2025 policy revision confirmed that crypto assets will gain formal financial-product status under the forthcoming FIEA Amendments (2026 implementation), bringing them under the same disclosure and risk-governance standards as securities. The Japan Virtual and Crypto Assets Exchange Association (JVCEA), a self-regulatory body endorsed by the FSA, also tightened listing requirements in 2025, reducing token-approval timelines from six months to one and increasing transparency for investors. This evolution reinforces Japan’s identity as a high-trust market where rule-based predictability supports both institutional innovation and consumer confidence.

Japan’s tax environment is steadily becoming more competitive. After years of debate, policymakers moved toward reforming the treatment of unrealized crypto gains held by corporations, with the 2025 Tax Reform Package approving tax exemptions for token holdings of approved blockchain firms. Individuals remain subject to progressive tax rates of up to 55 percent on short-term crypto income, but long-term capital-gains relief is under consideration. These adjustments, combined with the FSA’s clear licensing regime, have prompted new market entrants such as SBI VC Trade, bitFlyer Holdings, and GMO Coin to expand tokenized-asset and stablecoin services. The Bank of Japan (BoJ), meanwhile, continues its digital yen pilot in collaboration with Mitsubishi UFJ Financial Group and several regional banks, testing wholesale CBDC settlement scenarios and smart-contract interoperability. These developments point toward a Japan that prefers institutional innovation led by incumbents rather than disruption by startups.

Culturally and behaviorally, Japan’s crypto users display measured confidence rather than speculative enthusiasm. Roughly 6.5 million residents, or about 5 percent of adults, own crypto assets, with stablecoins and utility tokens gaining traction through payment and loyalty integrations. The market skews toward older, financially literate investors who value regulatory protection, data privacy, and long-term brand reputation. In 2025, several conglomerates integrated blockchain for customer engagement and loyalty, including Rakuten’s NFT marketplace, LINE’s token economy, and Sony’s digital collectibles platform. This corporate adoption reflects Japan’s cultural preference for reliability and incremental innovation.

The projected revenue in the Cryptocurrencies market in Japan (May 2025)

The number of users in the Cryptocurrencies market in Japan (May 2025)

South Korea

In South Korea, the Virtual Asset User Protection Act, enacted in July 2024 and fully enforced in early 2025, introduced clear standards for asset custody, reserve management, and disclosure obligations for all exchanges and wallet providers. The law empowers the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) to oversee market conduct and enforce criminal penalties for insider trading, fraud, and manipulation. Regulators also initiated pilots for crypto-based ETFs and cross-border transaction registries, positioning Korea as an innovation testbed within Asia’s compliance-driven framework. This combination of strict supervision and continuous experimentation has created a stable yet agile ecosystem that attracts both domestic users and institutional entrants.

Korea’s tax and institutional landscape continues to evolve in parallel. The government delayed the 20 percent capital-gains tax on virtual assets to 2026, giving exchanges and investors more time to adapt to new accounting and reporting standards. Meanwhile, local banks and fintechs such as KakaoBank, K-Bank, and Toss have deepened partnerships with licensed exchanges to enable seamless fiat–crypto integration under anti-money-laundering (AML) oversight. The Upbit platform, operated by Dunamu, remains the market leader with more than 70 percent domestic trading share, followed by Bithumb, Coinone, and Korbit. Institutional players, including Shinhan Bank and NH Investment & Securities, have launched tokenization and custody divisions, reflecting South Korea’s steady movement toward institutional-grade blockchain finance.

Consumer engagement in Korea reflects its hyper-digital and socially networked culture. Crypto ownership among adults reached 12.9 percent in 2025, up two percentage points from the previous year, with the majority of users under 40 and active across mobile payment and gaming ecosystems. Web3 adoption often overlaps with Kakao’s blockchain network (Klaytn) and Naver’s metaverse platform (Zepeto), showing how mainstream technology brands shape user trust. Marketing strategies that perform well in Korea rely on cultural fluency, security transparency, and social integration—using influencers, community events, and super-app ecosystems rather than speculative advertising. The South Korean market rewards precision and authenticity, where blockchain success depends not on novelty but on how seamlessly it integrates into users’ digital lifestyles.

The projected revenue in the Cryptocurrencies market in South Korea (May 2025)

The number of users in the Cryptocurrencies market in South Korea (May 2025)

Hong Kong: China’s Regulated Gateway

In 2025, Hong Kong strengthened its position as Asia’s most structured virtual-asset center by combining global transparency with Chinese policy discipline. The Securities and Futures Commission (SFC) expanded the list of licensed Virtual Asset Trading Platforms (VATPs) to seven, including HashKey Exchange, OSL, and newly approved firms such as Victory Securities and Hamsa Digital. These platforms operate under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) Amendment 2023, which mandates client-asset segregation, real-name verification, and investor-suitability checks. The SFC’s 2025 circular on cross-border order-book sharing opened controlled liquidity links between Hong Kong and overseas affiliates, lifting institutional participation and raising on-chain transaction value by 48 percent year-on-year.

Taxation and compliance policy remain central to Hong Kong’s international competitiveness. The Inland Revenue Department (IRD) reaffirmed in 2025 that profits from virtual-asset trading are taxable only when they arise from business activities conducted in or from Hong Kong, while long-term individual gains are generally exempt. This territorial principle keeps Hong Kong attractive for high-net-worth investors and family offices seeking clarity and low effective rates. The government’s updated Policy Statement on Virtual Assets introduced a forthcoming licensing framework for stablecoin issuers and custodians under SFC supervision. Alongside these developments, the approval of spot Bitcoin and Ether ETFs in 2024 catalyzed market depth; by mid-2025 the products managed about USD 1.7 billion in assets. Large financial institutions such as HSBC, Standard Chartered, and ZA Bank now provide fiat-settlement rails, while native leaders including Animoca Brands and BC Technology Group extend the ecosystem into gaming, tokenization, and digital-identity infrastructure.

User adoption in Hong Kong has become both affluent and compliance-driven. About 800 000 residents—roughly 11 percent of internet users—actively hold or trade digital assets, with participation concentrated in regulated ETFs, stablecoin payments, and tokenized-investment platforms. Surveys show that three-quarters of users prioritize licensing transparency and institutional backing over yield incentives, reflecting the city’s bilingual, financially literate culture. Within China’s “One Country, Two Systems” framework, Hong Kong functions as the Mainland’s policy observation window for blockchain finance. Its role in the Greater Bay Area allows Chinese institutions to experiment with tokenized securities and digital-currency interoperability through a legally distinct yet nationally connected gateway. For blockchain marketers, Hong Kong represents a hybrid frontier where compliance, credibility, and culture converge. Successful campaigns emphasize trust, regulation, and wealth stewardship, positioning the city as both a testing ground for Chinese innovation and a global showcase for regulated digital-asset growth.

The projected revenue in the Cryptocurrencies market in Hong Kong (May 2025)

The number of users in the Cryptocurrencies market in Hong Kong (May 2025)

Southeast Asia’s Triad: Malaysia, Thailand, and Vietnam

In 2025, Malaysia, Thailand, and Vietnam form Southeast Asia’s most dynamic trio in the blockchain and crypto economy—each representing a different stage of market maturity. Together, they account for more than 25 million active crypto users, up nearly 30 % year-on-year, positioning the region as the world’s fastest-growing digital-asset corridor. Regulatory clarity and consumer culture differ sharply: Malaysia prioritizes compliance and inclusion, Thailand drives innovation and retail engagement, while Vietnam leads on grassroots adoption and developer energy. For marketers, understanding these contrasts is key to capturing Southeast Asia’s momentum through localized strategy.

Malaysia continues to project cautious confidence. Under the Capital Markets and Services (Prescription of Securities) (Digital Currency and Digital Token) Order 2019, all digital asset exchanges must register as Recognized Market Operators (RMOs) with the Securities Commission (SC), supervised jointly with Bank Negara Malaysia (BNM). As of 2025, four licensed exchanges—Luno, Tokenize, MX Global, and Sinegy—operate under AML and client-protection mandates, with renewed 2025 guidelines on stablecoin classification. Crypto remains taxable as income only when trading is frequent or professional; long-term holding is exempt, a nuance that favors savings-oriented narratives. Malaysia’s estimated 4.5 million users view digital assets as a long-term diversification tool or remittance channel rather than speculation. Marketing in Malaysia works best when framed around trust, literacy, and Islamic finance compliance, as the BNM’s Shariah Advisory Council continues to assess tokenization for sukuk and microfinance.

Thailand, in contrast, has adopted a pro-innovation and consumer-led approach. In 2024, the government permanently removed the 7 % VAT on digital-asset trades and extended the 15 % capital-gains tax exemption for transactions through licensed platforms. The Securities and Exchange Commission (SEC Thailand) and the Bank of Thailand (BoT) jointly oversee tokenized investments, while the Finance Ministry licenses digital-asset service providers under a clear, public registry. Crypto ownership surpassed 7 million users in 2025, roughly 10 % of the adult population, with strong participation in NFTs, GameFi, and tokenized loyalty programs. Local players like Bitkub and Upbit Thailand have become household brands, and tourism-linked “crypto for travel” initiatives now integrate stablecoin payments across Thai resorts. The market’s behavior is mobile-first, social-media-native, and incentive-driven, rewarding brands that connect blockchain with lifestyle experiences and digital entertainment.

Vietnam bridges both extremes, combining grassroots participation with regulatory evolution. Ranked among the top five countries in the 2025 Chainalysis Global Adoption Index, Vietnam has an estimated 9 million active users, fueled by affordable access, high digital literacy, and strong community culture. While the government still prohibits crypto as legal tender, it allows trading and holding under general financial law, and the State Bank of Vietnam completed a 2025 feasibility study for a blockchain-based digital dong pilot. Taxation remains case-by-case: gains are treated as income but enforcement is limited, which gives startups operational flexibility but also creates messaging ambiguity. Vietnam’s strength lies in its developer ecosystem—hundreds of Web3 and gaming startups such as Axie Infinity’s Sky Mavis and Sipher anchor a thriving export-oriented blockchain economy. For marketers, Vietnam is a story of grassroots innovation, where community trust, education, and storytelling around opportunity outperform institutional appeal.

These three markets illustrate how the same region can host divergent success models. Malaysia’s framework rewards credibility and regulation-first storytelling that appeals to institutions and risk-conscious investors. Thailand offers culture-led innovation, where campaigns thrive on lifestyle integration, gaming, and loyalty ecosystems. Vietnam demands community-driven authenticity, using influencer credibility, educational partnerships, and developer engagement. The strategic opportunity for 2025 and beyond lies in building regional narratives that connect compliance, creativity, and community—linking Malaysia’s trust, Thailand’s engagement, and Vietnam’s grassroots innovation into a coherent Southeast Asian growth story.

The projected revenue in the Cryptocurrencies market in Thailand, Malaysia, and Vietnam (May 2025)

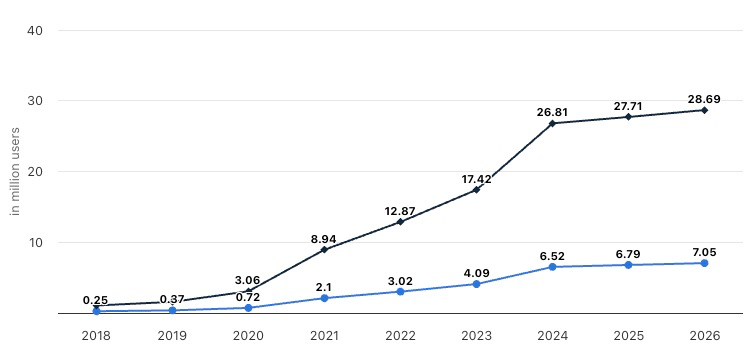

The number of users in the Cryptocurrencies market in Thailand, Malaysia, and Vietnam (May 2025)

United Arab Emirates (Dubai)

In 2025, the United Arab Emirates reaffirmed its position among the world’s top five crypto hubs, driven by regulatory clarity, sovereign backing, and its ability to merge digital-asset innovation with a luxury-oriented economy. The Virtual Assets Regulatory Authority (VARA), established in 2022, released its complete 2025 Rulebooks covering seven verticals, including service provision, custody, issuance, and market conduct. These updates introduced detailed requirements for fiat-referenced and asset-referenced tokens, insider-trading prevention, and marketing disclosures that apply to both global and local brands operating in Dubai. The Free-Zone model, led by Dubai Multi Commodities Centre (DMCC) and Abu Dhabi Global Market (ADGM), enabled flexible licensing and cross-border access. As of mid-2025, digital-asset licenses in Dubai’s free zones increased by 38% year-on-year, reflecting a deliberate shift from early-stage startups to institutional players entering the Middle East.

Taxation and regulatory alignment distinguish the UAE from most of Asia’s crypto jurisdictions. The country has no personal income or capital-gains tax on digital-asset trading and applies a low 9 percent federal corporate tax only to specific profit thresholds. This combination of low taxation and comprehensive compliance creates an ecosystem where innovation and regulation coexist. The VARA rulebooks require all marketing and advertising to include risk disclaimers and prohibit misleading yield claims, setting standards similar to the EU’s MiCA framework but executed through a centralized local authority rather than supranational coordination. The ADGM’s Financial Services Regulatory Authority (FSRA) complements this regime with the world’s first “Prudential Rulebook for Virtual Asset Firms”, published in early 2025, which formalizes capital adequacy and governance requirements. The result is a regulatory environment that offers predictability without bureaucracy, appealing to institutional entrants who prefer speed and clarity over procedural complexity.

The UAE’s market structure and consumer base also differ sharply from hubs such as Singapore or Hong Kong. In Dubai, high-net-worth individuals, global investors, and crypto-tourists dominate transaction flows, while the retail segment remains comparatively small but affluent. Digital-asset ownership in the Emirates reached 4.5 million users in 2025, or about 44 percent of adults, one of the highest per-capita rates globally. User behavior is aspirational, with crypto framed as both a symbol of wealth modernization and a practical portfolio tool. Major players include Binance MENA, OKX MENA, BitOasis, and local custodians such as Laser Digital Middle East, all licensed under VARA or ADGM. Marketing in Dubai therefore emphasizes bilingual storytelling, experiential engagement, and status alignment—integrating blockchain with art, real estate, and luxury events. Unlike Asian counterparts where compliance is the main selling point, the UAE’s advantage lies in positioning crypto as lifestyle infrastructure, linking technological legitimacy with national branding and tourism. This intersection of regulation, wealth, and soft power makes the Emirates not just a compliant jurisdiction but a distinctive cultural epicenter in the global digital-asset economy.

The projected revenue in the Cryptocurrencies market in United Arab Emirates (May 2025)

The number of users in the Cryptocurrencies market in United Arab Emirates (May 2025)

Germany and the European Union

Europe’s center of gravity in 2025 is the live implementation of MiCA, which now governs stablecoin issuance and the authorization of crypto-asset service providers across the bloc. ESMA finalized knowledge and competence guidelines for staff who advise on or market crypto products, which means European campaigns must evidence trained teams and compliant disclosures, not only product features. National authorities, including France’s AMF and Germany’s BaFin, are running MiCA transition tracks that move registered firms toward full authorization and tighten expectations on custody, market integrity, and client communications. This is the first cycle in which harmonized European rules directly shape how marketers describe suitability, risk, and customer rights at scale.

Germany’s policy context blends EU harmonization with distinctive tax certainty. The Federal Finance Ministry’s 2025 circular clarified several open tax questions including how airdrops and certain income categories are treated, while Germany continues to recognize that privately held crypto sold after one year is tax-free for individuals under existing income tax rules, which supports long-term positioning and tokenized savings narratives. Institutional tokenization pilots expanded, and Germany’s crypto ownership rate is estimated around nine percent, up more than one percentage point, with institutional assets rising by about a quarter year over year. For brand strategy this rewards messages that link regulated custody, MiCA-aligned client protection, and Germany’s long-standing retail tax clarity for long-held assets.

France is translating policy into market access. The AMF introduced new 2025 documentation standards for crypto-asset service provider authorizations and continues to align local regimes with MiCA, including product and disclosure completeness tests. That process underpins the rapid scaling of tokenization in fund wrappers and provides a template for marketers to speak about admission criteria, custody segregation, and the investor protections that sit behind French-domiciled products. In continental campaigns this matters because French approvals often set a reference level for disclosure discipline across the single market.

The projected revenue in the Cryptocurrencies market in Germany and France (May 2025)

The number of users in the Cryptocurrencies market in Germany and France (May 2025)

On the user side, Europe’s growth is steady rather than explosive, yet transaction quality is improving as more activity migrates into supervised channels. Audiences respond to trust, transparency, and sustainability claims when these maps explicitly to MiCA titles, for example what consumer rights exist for a particular stablecoin or what knowledge standards the sales staff meet. The practical outlook for 2025 to 2026 is continued authorization waves, more tokenized fund launches, and cross-border campaigns that reuse a common compliance spine while adapting creative to local financial culture.

Switzerland

Switzerland stands as Europe’s most mature and precisely regulated blockchain economy, a jurisdiction where legal certainty and financial heritage underpin global credibility. The Distributed Ledger Technology (DLT) Act, in force since 2021, and the FINMA ICO Guidelines remain the cornerstone of the country’s digital-asset framework, providing explicit definitions for token issuance, custody, and ledger-based securities. Building on this foundation, FINMA’s 2025 regulatory updates expanded the national sandbox for tokenized investment funds and introduced a pilot licensing framework for digital Swiss franc (CHF) payment systems, allowing banks and fintechs to test blockchain-based settlement under supervisory oversight. Zug’s Crypto Valley continues to thrive with more than 1,200 registered blockchain firms, up 9 percent from 2024, and a specialized workforce exceeding 6,000 professionals. This concentration of expertise has made Switzerland a global reference point for the institutionalization of Web3 finance.

Switzerland’s tax environment complements its legal clarity. The federal government treats cryptocurrencies as assets subject to wealth tax but exempts long-term capital gains for private individuals, while professional trading remains taxable as income. The Swiss Federal Tax Administration (SFTA) simplified 2025 reporting for tokenized securities and staking rewards, and several cantons—most notably Zug and Zurich—offer crypto-friendly tax rulings and payment acceptance for certain taxes in Bitcoin or Ether. This stable, predictable fiscal treatment supports the migration of blockchain investment funds, custody services, and family offices into Switzerland. Combined with world-class financial institutions such as UBS, Julius Baer, and Credit Suisse (UBS Group) entering the tokenization and digital-bond markets, Switzerland has effectively merged traditional finance with blockchain infrastructure. SEBA Bank and Sygnum continue to set global benchmarks for licensed crypto banking, custody, and asset management, bridging retail access with institutional-grade compliance.

User and market behavior in Switzerland differ significantly from retail-heavy jurisdictions. Adoption is steady but sophisticated, with roughly 13 percent of adults holding digital assets and usage skewing toward investment, tokenized real estate, and regulated funds rather than speculative trading. Cross-border institutions increasingly use Switzerland as a structuring hub for European tokenization vehicles, while domestic fintechs specialize in DeFi compliance, stablecoin issuance, and digital identity. Marketing in this environment succeeds when it connects innovation to financial heritage—highlighting governance, audit transparency, and cross-border interoperability. For global blockchain marketers, Switzerland represents a credibility multiplier: a jurisdiction where compliance is a competitive advantage and where brand positioning around precision, trust, and institutional alignment carries the most influence in Europe’s evolving digital-asset landscape.

The projected revenue in the Cryptocurrencies market in Switzerland (May 2025)

The number of users in the Cryptocurrencies market in Switzerland (May 2025)

Portugal

Portugal’s proposition in 2025 is clarity for retail and a straightforward route for firms. Capital gains on crypto held less than 365 days are generally taxed at a flat twenty-eight percent, while gains on assets held longer than a year are typically exempt for individuals, subject to conditions. This bifurcation enables long-term wealth messaging and reduces headline risk for retail campaigns, provided brands avoid implying blanket exemptions. Company formation and VASP registration remain comparatively simple, which helps startups move from test to market without jurisdictional surprises.

User behavior in Lisbon and Porto blends tech adoption with lifestyle patterns. A visible digital nomad population and a dense meetup culture support education-led funnels, while local merchants increasingly experiment with wallet acceptance. For marketers this favors city-level activations, tourism partnerships, and creator collaborations. The twelve-month outlook is incremental tightening of AML supervision alongside continued community growth, which still leaves Portugal attractive for consumer apps, self-custody tools, and tokenized membership models that reward longer holding periods.

The projected revenue in the Cryptocurrencies market in Portugal (May 2025)

The number of users in the Cryptocurrencies market in Portugal (May 2025)

Estonia and Malta

Estonia has shifted from the early, easy-license era to an institutional-grade regime. By 2025 applicants face higher share capital thresholds for certain transfer services, clear economic-substance requirements, and mandatory local AML officers, with supervision transitioning toward full MiCA alignment. The net effect is fewer licenses but higher credibility for those that remain, which marketers can translate into simple promises about safeguarding, staffing, and governance. Estonia’s e-residency and digital-first public services still make it a compelling base for developer-led brands that want to showcase real government-scale blockchain competence.

Malta has synchronized its Virtual Financial Assets framework with the EU’s new regime. The MFSA’s 2024 and 2025 circulars lay out the authorization path from VFA to MiCA, including application fee schedules and transitional categories. For marketers this enables clean statements about authorization journeys and consumer protections during the transition. The island retains its “innovation testbed” appeal, yet 2025 communications should underscore MiCA readiness, board-level risk oversight, and service continuity as firms relicense. Expect more institutional tokenization and white-label service plays routed through Malta for EU distribution in 2026.

The projected revenue in the Cryptocurrencies market in Estonia and Malta (May 2025)

The number of users in the Cryptocurrencies market in Estonia and Malta (May 2025)

Australia and Canada

Australia spent 2025 clarifying how existing financial laws apply to digital assets while Treasury’s reform program advances. ASIC’s updated guidance gives firms more certainty about product classification, custody, and disclosure obligations, and it telegraphs transitional support while the parliament considers dedicated legislation. User ownership is approaching ten percent, up nearly two percentage points, and the market’s culture prizes investor protection, retirement integration, and bank partnerships. Marketers should lean into superannuation-friendly narratives, plain-English risk language, and locally trusted distribution partners.

Canada’s edge is regulated spot ETF depth and a seasoned supervisory perimeter under the CSA. Canadian Bitcoin ETFs, led by the Purpose Bitcoin ETF and peers, anchor mainstream exposure and create a lawful referral point for brand storytelling about safe access and custody. AUM across leading products remains in the multi-billion range, and global institutional flows into North American ETFs continue to normalize crypto as a portfolio line item. Campaigns aimed at Canadian investors work best when they connect product utility to retirement accounts, fee transparency, and the custody stack behind listed vehicles.

The projected revenue in the Cryptocurrencies market in Australia and Canada (May 2025)

The number of users in the Cryptocurrencies market in Australia and Canada (May 2025)

Turkey

In 2025, Turkey consolidated its reputation as one of the world’s most active and pragmatic retail crypto markets, where economic pressure fuels adoption rather than speculation. Around 25 percent of internet users—approximately 21 million people—own digital assets, a ratio that continues to rise despite market volatility. Persistent inflation, averaging over 50 percent in early 2025, and the weakening of the Turkish lira have turned stablecoins such as USDT and USDC into de facto savings and remittance instruments. Daily crypto transaction volumes on local exchanges routinely exceed USD 1 billion, positioning Turkey among the top five markets globally by retail on-chain activity. This behavior reflects a functional relationship between crypto and currency resilience, where users adopt blockchain not for ideology but for access, speed, and protection against value erosion.

The 2025 Draft Law on Crypto Asset Markets, submitted to the Turkish Grand National Assembly in Q1 2025, represents the country’s most comprehensive attempt to formalize its digital-asset framework. The bill establishes licensing regimes for exchanges, custodians, and wallet providers, mandates Capital Markets Board (CMB) oversight, and introduces explicit marketing and advertising disclosure rules aligned with Financial Crimes Investigation Board (MASAK) standards. While taxation remains under review, policy proposals suggest a 15 percent capital-gains tax on short-term speculative profits and exemptions for long-term holdings, a model inspired by the EU’s MiCA framework. This dual approach—tight regulation combined with moderate taxation—signals Turkey’s intention to balance consumer protection with innovation, enabling local firms such as Paribu, BTCTurk, and Bitci to attract both domestic and regional users under clearer compliance expectations.

User behavior in Turkey remains highly digital, community-driven, and education-sensitive. A large share of new adopters are young, mobile-first, and motivated by financial independence rather than high-risk trading. The market rewards transparency and localized engagement: campaigns that provide Turkish-language financial education, explain custodial risk, and highlight licensed partnerships consistently outperform speculative promotions. Banks including Garanti BBVA and Akbank are preparing direct on-ramps as formal regulation approaches, and advertising rules are expected to tighten within the year. For marketers, Turkey offers a uniquely resilient yet fast-evolving market—a bridge between emerging-market urgency and institutional ambition. Success depends on building credibility through compliance, financial literacy, and practical use cases that connect blockchain to everyday purchasing power and remittance needs.

The projected revenue in the Cryptocurrencies market in Turkey (May 2025)

The number of users in the Cryptocurrencies market in Turkey (May 2025)

South Africa and Nigeria

South Africa is the continental reference point for licensing and supervision. The FSCA has already approved dozens of crypto licenses and continues to supervise a broad pipeline of applicants, following its designation of crypto as a financial product. This brings exchange-style platforms into conduct and AML frameworks and gives marketers a lawful anchor for claims about authorization and client protections. User adoption is steady with strong retail and SME interest in payments and trading. The near-term trend is deeper integration with banks and payment rails, which will make regulated distribution partnerships the primary growth lever.

Nigeria is moving from de facto adoption to de jure clarity. The Finance Act brought digital assets explicitly into the capital gains tax net at ten percent, and commentary through 2025 indicates broader tax architecture and SEC rule updates are underway, including proposals that would take effect from mid 2025 and incubation programs for VASPs. The Central Bank’s 2025 circulars around the Pan-African Payment and Settlement System simplify cross-border documentation and align with the country’s ambition to formalize flows, while policymakers look again at stablecoin utility after limited eNaira uptake. For marketers this mix supports payments, remittances, and small-business use cases, but it also demands careful tax and disclosure language and local partnerships for compliance.

User behavior in both markets is mobile-first and utility-driven. Education outperforms hype, and community programs tied to entrepreneurship, creator income, or SME payments deliver better retention than trading-only pitches. Over the next year expect more formal guidance on advertising and disclosures, broader merchant acceptance, and, in Nigeria, continued policy experiments that recognize the role of stablecoins in day-to-day commerce.

The projected revenue in the Cryptocurrencies market in South Africa and Nigeria (May 2025)

The number of users in the Cryptocurrencies market in South Africa and Nigeria (May 2025)

Why Understand Countries' Regional Facts Matter

Together these countries represent >80 % of global on-chain volume and >70 % of active users. They combine mature finance ecosystems (USA, Switzerland, Germany, Singapore) with rapid adoption frontiers (India, Turkey, Nigeria). In conclusion, the insights underline a profound shift in the blockchain and crypto ecosystem: from niche innovation to mainstream infrastructure. As adoption rates accelerate and institutional participation deepens across the top jurisdictions, the marketing moment has evolved. It is no longer sufficient simply to reach early adopters. Brands must craft compelling narratives around real-world utility, regulatory alignment, and cultural relevance.

Looking ahead, three innovation trends stand out as defining the next phase of growth. First, tokenization of real-world assets, everything from real-estate shares to fine art, will migrate from pilot to production, opening new marketing frontiers focused on ownership, access and community. Second, the fusion of DeFi, payments and traditional finance will intensify, particularly in regions where crypto adoption is strongest, enabling marketers to tell stories of financial inclusion and product innovation rather than pure speculation. Third, regulatory-framework convergence will accelerate, driven by markets listed in the Index, enabling greater cross-border interoperability and easing global roll-out for compliant platforms.

Embrace the language of legitimacy, partner with ecosystem credentials, and localize strategy at scale. The most successful campaigns will not just promote features but embed themselves in trusted frameworks, speak to real-life use cases, and reflect the cultural and regulatory realities of each market. The future of crypto marketing is less about hype and more about infrastructure, adoption and meaningful utility.

Disclaimer: The content on this website is for marketing innovation and education purposes only and should not be considered investment advice.

Follow us

Website: www.teramy.academy

LinkedIn: linkedin.com/company/teramy-academy

Twitter: https://x.com/teramyacademy

Comments